Table of Contents

UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

| |

SCHEDULE 14A |

| |

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

| |

Filed by the Registrant ☒ |

| |

Filed by a Party other than the Registrant ☐ |

| |

Check the appropriate box: |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

|

Canterbury Park Holding Corporation |

(Name of Registrant as Specified In Its Charter) |

| |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

☒ | No fee required. |

| |

Payment of Filing Fee (Check the appropriate box): |

☒☐ | No fee required.Fee paid previously with preliminary materials |

☐ | |

☐ | Fee computed on table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

CANTERBURY PARK HOLDING CORPORATION

1100 Canterbury Road

Shakopee, Minnesota 55379

(952) 445-7223

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

June 6, 20182, 2022

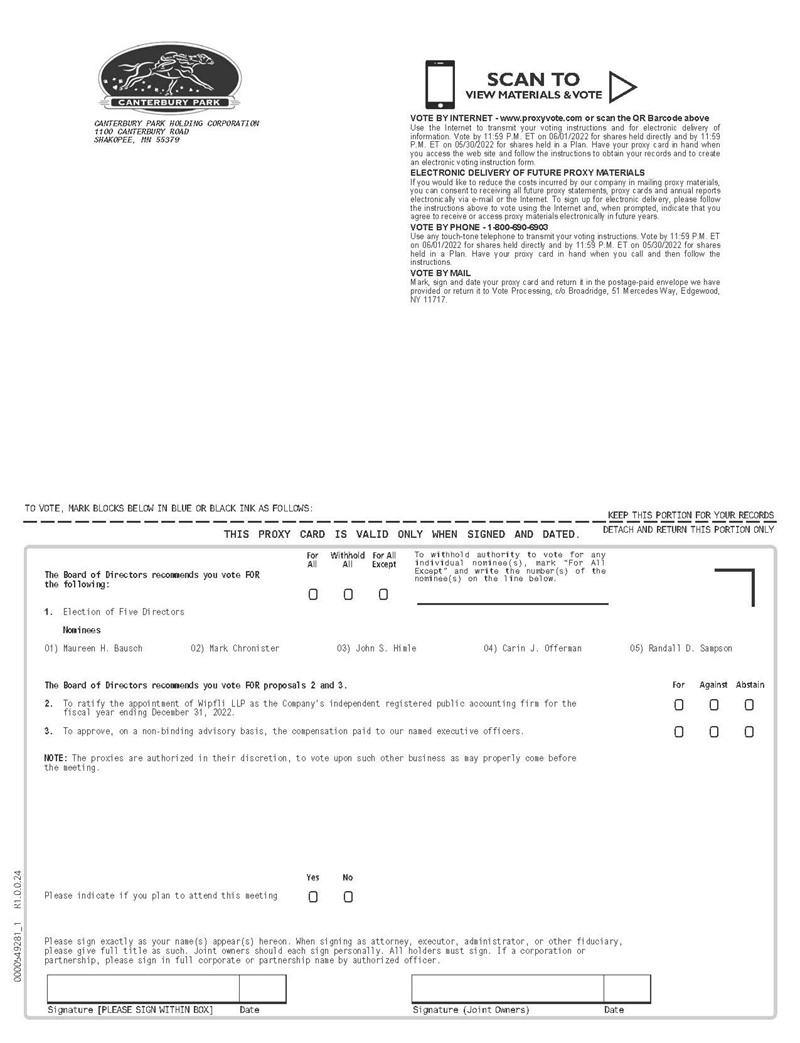

Notice is hereby given that the Annual Meeting of Shareholders of Canterbury Park Holding Corporation will be held in the Triple Crown Room at Canterbury Park, 1100 Canterbury Road, Shakopee, Minnesota 55379, on Wednesday,Thursday, June 6, 2018,2, 2022, beginning at 10:00 a.m. local time, for the following purposes:

| 1. | To elect five directors to hold office until the 2019next Annual Meeting of Shareholders or until their successors are elected;elected and qualified; |

| 2. | To ratify the appointment of Wipfli LLP (“Wipfli”) as the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2018.2022; and |

| 3. | To approve, on a non-binding basis, the compensation paid to our named executive officers. |

The Board of Directors has fixed the close of business on April 11, 20187, 2022 as the record date for the determination of shareholders entitled to notice of and to vote at the meeting.

As our Annual Report to Shareholders for 2017,2021, we are also separately supplying our Annual Report on Form 10-K for the year ended December 31, 2021 as filed with the Securities and Exchange Commission on March 27, 2018.18, 2022.

All shareholders are cordially invited to attend the Annual Meeting of Shareholders in person.Whetheror not you expect to attend, please vote as soon as possible. If your shares are registered in your name, information regarding how you can vote in person, over the Internet or by mail is provided in the materials sent to you, and, if you have received a proxy card, it provides information on how to vote your shares. If you hold shares beneficially through a financial institution or other nominee, please follow the voting instructions it provides. Shareholders who attend the meeting may revoke their proxies and vote in person if they so desire.

| By Order of the Board of Directors, /s/ Randall D. Sampson Randall D. Sampson President and Chief Executive Officer |

Shakopee, Minnesota

April 24, 2018

19, 2022

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS: Copies of this Notice, the Proxy Statementproxy statement following this Notice and the Company’sCompany’s Annual Report on Form 10-K for its 20172021 fiscal year are available at: http:https://canterburypark.investorroom.com/sec-filingscanterbury-park-holding-corporation.ir.rdgfilings.com/all-sec-filings/. |

CANTERBURY PARK HOLDING CORPORATION

PROXY STATEMENT

TABLE OF CONTENTS

CANTERBURY PARK HOLDING CORPORATION

________________________

PROXY STATEMENT FOR JUNE 6, 20182, 2022 ANNUAL MEETING OF SHAREHOLDERS

________________________

GENERAL INFORMATION

This Proxy Statementproxy statement is being provided on behalf of the Board of Directors (the “Board”) of Canterbury Park Holding Corporation (the “Company,” “Canterbury,” or “we”) in connection with the Annual Meeting of Shareholders to be held at Canterbury Park, 1100 Canterbury Road, Shakopee, Minnesota 55379, on Wednesday,Thursday, June 6, 2018,2, 2022, beginning at 10:00 a.m. Central Daylight Time (the “Annual Meeting”). The Board of Directors is soliciting proxies to be voted at the Annual Meeting, and at any adjournment and reconvening of the meeting. We first made this Proxy Statementproxy statement available to our shareholders on or about April 24, 2018.19, 2022.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

What is the purpose of the meeting?

At our Annual Meeting, shareholders will be asked to vote on twothree matters. These are:

| ·● | The election of five directors.directors; |

| ·● | Ratifying the appointment of Wipfli LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2018.2022; and |

| ● | Approval, on a non-binding basis, the compensation paid to our named executive officers. |

TheDuring the informal portion following the formal portion of the Annual meeting, the Company’s management will also report on the Company’s performance during the last fiscal year and respond to appropriate questions from shareholders.

Will any other business be conducted?

While we do not expect that other business will be conducted at the Annual Meeting, we will consider other business, if any, that is properly presented at the meeting.

How does the Board recommend that I vote?

The Board of Directors named in this proxy statement recommends a vote “FOR” the election of each of the Company’s nominees for director and “FOR” ratification of the appointment of Wipfli LLP as our registered independent public accounting firm.vote:

| ● | “FOR” the election of the five nominees recommended by the Board of Directors; |

| ● | “FOR” the ratification of the appointment of Wipfli LLP; and |

| ● | “FOR” the approval, on a non-binding basis, the compensation paid to our named executive officers. |

Who is entitled to vote at the meeting?

If you wereare a shareholder of record at the close of business on April 11, 2018,7, 2022, you are entitled to vote at the meeting. As of the record date, 4,449,987April 7, 2022, there were 4,831,686 shares of common stock were outstanding and eligible to vote.

What is the difference between a shareholder of record and a street name holder?

If your shares are registered directly in your name, you are considered the “shareholder of record” for those shares. If your shares are held in a stock brokerage account or by a bank or other nominee, you

are considered the “beneficial owner” of those shares, and your shares are held by the financial institution or nominee in “street name.” If you are a “street name” holder, you will receive a voting instruction card, which is very similar to a proxy card. Please complete that cardfollow the voting instructions as directed on your voting instruction card in order to ensure your shares are voted at the meeting.

What are the voting rights of the shareholders?

Holders of common stock are entitled to one vote per share. There is no cumulative voting for the election of directors.

How many shares must be present to hold the meeting?

A quorum is necessary to hold the meeting and conduct business. The presence, in person or by proxy, of shareholders who can together vote at leastthe holders of a majority of the outstanding shares of common stock asvoting power of the record date is considered a quorum. A shareholder is counted as present at the meeting if the shareholder is present and votes in person at the meeting or if the shareholder has properly submitted a proxy by mail, telephone or Internet. In addition, if a beneficial shareholder is not present in person and has not submitted a proxy, but the financial institution or other nominee has the limited powershares entitled to vote the shares for the ratification of the independent registered public accounting firm, than those shares will be considered present for that agenda item and will count toward establishingat a meeting constitutes a quorum.

If the broker, bank, trustee or other nominee that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, that organization will inform us that it does not have the authority to vote on the matter with respect to your shares. This is generally referred to as a “broker non-vote.” Broker non-votes and abstentions are counted for purposes of determining whether a quorum is present.

How do I vote my shares?

If you are a shareholder of record, you may give a proxy to be voted at the meeting either by:

| ·● | Accessing the Internet website specified on your proxy card; |

| ·● | Calling the toll-free number specified on your proxy card; or |

| ·● | Signing and returning your proxy card in the postage-paid envelope provided. |

If you hold shares beneficially in street name, you may also vote your shares by accessing the Internet website specified on your proxyvoting instruction card, by telephone or by mail following the instructions provided to you by your broker, bank, trustee or nominee. The telephone and Internet voting procedures have been set up for your convenience. The procedures have been designed to authenticate your identity, to allow you to give voting instructions, and to confirm that those instructions have been recorded properly. You may also vote in person at the meeting as described below in “May I vote my shares in person at the meeting?” below.

What does it mean if I receive more than one proxy card or voting instruction card?

It means you hold shares of the Company stock in more than one account. To ensure that all of your shares are voted, sign and return each proxy card or voting instruction card or, if you vote by telephone or via the Internet, vote once for each proxy card or voting instruction card you receive.

May I vote my shares in person at the meeting?

Yes.If you are a shareholder of record, you may vote your shares at the meeting by completing a ballot at the meeting. Even if you currently plan to attend the meeting, however, we recommend that you submit your proxy ahead of time so that your vote will be counted if, for whatever reason, you later decide not to not attend the meeting.

If you hold your shares in street name, and then decide to attend the meeting, you may vote your shares in person at the meeting only if you obtain a signed proxy from your broker, bank, trustee or other nominee giving you the right to vote these shares at the meeting.

What vote is required to elect directors?for each proposal?

Directors are elected by a plurality of the votes cast at the Annual Meeting by holders of common stock voting for the election of directors. This means that since shareholders will be electing five directors as part of Proposal 1, the five nominees receiving the highest number of votes will be elected.

The five director nominees receivingaffirmative vote of a majority of the most votesoutstanding shares of the Company’s common stock voting at the annual meeting in person or by proxy is required for electionProposal 2, shareholder ratification of the appointment of Wipfli to the Board will be electedserve as the Company’s directors.independent registered public accounting firm for the 2022 fiscal year.

Approval of Proposal 3 relating to the compensation paid to our named executive officers, requires the affirmative vote of the holders of the majority of the shares present, in person or by proxy, and entitled to vote on Proposal 3.

How are votes recorded and counted?

Shareholders may either vote FOR or WITHHOLD authority to vote for each nominee for election to the Board of Directors.Directors identified in Proposal 1. Shareholders may vote FOR, AGAINST, or ABSTAIN on the other proposals.Proposals 2 and 3.

If you vote ABSTAIN or WITHHOLD, your shares will be counted as present at the meeting for the purposes of determining a quorum. If you ABSTAIN from voting on a proposal, your abstention has the same effect as a vote against that proposal. If you WITHHOLD authority to vote for one or more of the nominees for director, this will have no effect on the election of any director from whom votes are withheld.withheld because directors are elected by a plurality.

Abstentions will be counted for purposes of calculating whether a quorum is present at the annual meeting, but are not counted for the purposes of determining whether shareholders have approved that matter. Therefore, if you ABSTAIN from voting on Proposals 2 and 3, your abstention has the same effect as a vote against that proposal.

Brokers who hold shares in street name have discretionary authority to vote on certain “routine” items even if they have not received instructions from the persons entitled to vote these shares. However, brokers do not have authority to vote on “non-routine” items without these instructions. If you hold your shares in street name and do not provide voting instructions to your broker or nominee, your shares will be considered to be “broker non-votes” and will not be voted on any proposal on which your broker or nominee does not have discretionary authority to vote. Shares that constitute broker non-votes will be present at the meeting for the purpose of determining a quorum but are not considered entitled to vote on proposals for which no instructions were given. Your broker or nominee has discretionary authority to vote your shares on the ratification of the appointment of Wipfli as our independent registered public accounting firm even if your broker or nominee does not receive voting instructions from you.

May I change my vote?

Yes. If you are a shareholder of record, you may change your vote and revoke your proxy at any time before it is voted at the meeting in any of the following ways:

| ·● | By sending a written notice of revocation to our Corporate Secretary; |

| ·● | By submitting another properly signed proxy card atwith a later date to our Corporate Secretary; |

| ·● | By submitting another proxyIf you voted by telephone or viathrough the Internet, at a later date;by voting again by telephone or through the Internet prior to the close of the voting facility; or |

| ·● | By voting in person at the meeting. |

If you are a street name holder, please consult your broker, bank, trustee or nominee for instructions on how to change your vote.

All shares represented by valid, unrevoked proxies will be voted at the Annual Meeting and any adjournment(s) or postponement(s) thereof.

Who pays for the cost of proxy preparation and solicitation?

We pay for the cost of preparing this proxy statement and this solicitation, including the charges and expenses of brokerage firms or other nominees for forwarding proxy materials to beneficial owners of shares held in street name.

We are soliciting proxies primarily by mail. In addition, proxies may be solicited by telephone or facsimile, or personally by our directors, officers and regular employees. These individuals will receive no compensation (other than their regular salaries) for these services.

How can a shareholder present a proposal at the 20192023 Annual Meeting?

In order for a shareholder proposal to be considered for inclusion in our Proxy Statementproxy statement for the 20192023 Annual Meeting the written proposal must be received at our principal executive offices by the close of business on December 24, 2018.21, 2022. The proposal must comply with SEC regulations regarding the inclusion of shareholder proposals in company-sponsored proxy materials. Please review “Other Information – Shareholder Proposals and Nominees for 20192023 Meeting” at the end of this Proxy Statement.proxy statement.

If a shareholder wishes to present a proposal at the 2019 Annual Meeting that would not be included in our Proxy Statement for that meeting, pleaseIn addition, shareholders should review “Other Information – Shareholder Proposals and Nominees for 20192022 Meeting” for more information regarding the steps to be taken under our bylaws for such proposal to present such a proposal.be properly brought before shareholders at our 2023 Annual Meeting, whether or not the proposal would be included in our proxy statement for that meeting.

How can a shareholder get a copy of the Company’s 2017Company’s 2021 Annual Report on Form 10-K?

Our Annual Report on Form 10-K for our fiscal year ended December 31, 20172021 is being supplied as our Annual Report to Shareholders for 20172021 with this Proxy Statement.proxy statement. It is also available electronically with this Proxy Statementproxy statement at the link on the Notice of Annual Meeting above. Our Annual Report on Form 10-K is also available at our website, www.canterburypark.comwww.canterburypark.com, by following the “SEC Filings” link in the “Investor Relations”“Investors” page. If requested, we will provide copies of any exhibits to the Form 10-K upon payment of a fee covering our reasonable expenses in furnishing the exhibits. You can request exhibits to the Form 10-K by writing to the Corporate Secretary, 1100 Canterbury Road, Shakopee, MN 55379.

What if I do not specify a choice for any matter when returning my proxy?

UnlessIf you indicate otherwise,just sign and submit your proxy without voting instructions, the persons named as proxies on the proxy card will vote your shares “FOR” the election of each of the nominees to the Board of Directors presented in Proposal 1 and “FOR” Proposal 2.each of Proposals 2 and 3.

If any other matters come up for a vote at the meeting, the proxy holders will vote according to the recommendations of our Board of Directors or, if there is no recommendation, in their own discretion.

CORPORATE GOVERNANCE AND BOARD MATTERS

General.

Our Board of Directors is committed to sound and effective corporate governance practices. Our policies comply with the rules of the Securities and Exchange Commission (“SEC”) and listing standards of the Nasdaq Stock Market (“Nasdaq”). We also periodically review our governance policies and practices in comparison to those suggested by authorities in corporate governance and the practices of other public companies.

You can access the charters of our Audit Committee, and our Compensation Committee, Governance Committee, and our Code of Conduct and our Corporate Governance Guidelinesin the Investor Relations Investorssection of our website atwww.canterburypark.com or by writing to the Investor Relations Department at: Canterbury Park Holding Corporation, 1100 Canterbury Road, Shakopee, Minnesota 55379, or by e-mailing our Investor Relations Department atinvestorrelations@canterburypark.com.

Director Independence.

The Board of Directors follows director independence guidelines that are consistent with the definitions of “independence” set forth in Nasdaq’s listing standards. In accordance with these guidelines, the Board of Directors has reviewed and considered facts and circumstances relevant to the independence of each of our current directors and our director nominees and has determined that, each of the following current directors qualifies as “independent” under Nasdaq listing standards: Burton F. Dahlberg,Maureen H. Bausch, Mark Chronister, John S. Himle, Carin J. Offerman and Dale H. Schenian. Our directors Curtis A. Sampson and Randall D. Sampson are not independent under Nasdaq listing standards.Current director Randall D. Sampson does not qualify as independent under Nasdaq listing standards because he is our President and Chief Executive Officer. Curtis A. Sampson does not qualify as independent under the Nasdaq listing standards because he is an immediate family member (father) of Randall D. Sampson.

Board Committees and Committee Independence.

Board Committees. Our Board of Directors has established twothree committees: an Audit Committee, a Compensation Committee, and a CompensationGovernance Committee. The composition and function of each of these committees are set forth below.

Audit Committee.Committee. The Audit Committee is responsible for the engagement, retention and replacement of the independent auditors, approval of transactions between us and a director or executive officer unrelated to service as a director or officer, approval of non-audit services provided by our independent registered public accounting firm, oversight of our accounting, financial reporting and internal controls, and the receipt, retention and treatment of complaints regarding accounting, internal controls and auditing matters. Wipfli, our independent registered public accounting firm, reports directly to the Audit Committee. The Audit Committee operates under a formal charter which was most recently amended on June 5, 2008.that is reviewed annually. The current members of the Audit Committee are Burton F. DahlbergMark Chronister (Chair), Carin J. Offerman, and Dale H. Schenian,John S. Himle, each of whom is independent under Rule 10A-3 of the Exchange Act and Nasdaq listing standards. Further, the Board of Directors has determined that Ms. Offerman meetsand Mr. Chronister meet the Securities and Exchange Commission definition of an “audit committee financial expert.” As required by its charter, all of the members of the Audit Committee meet the Nasdaq requirements regarding financial literacy and financial sophistication. The Audit Committee metheld four timesregular meetings during 2017.2021.

Compensation Committee. The Compensation Committee provides oversight of our overall compensation strategy, reviews and recommends to the Board of Directors the compensation of our Chief Executive Officer and the other executive officers, administers our equity-based compensation plans and oversees our 401(k) Plan and similar employee benefit plans. The Compensation Committee operates under a charter that was last amended in June 2008.is reviewed annually. The current members of the Compensation Committee are Carin J. Offerman (Chair), Burton F. Dahlberg,Maureen H. Bausch, and Dale H. Schenian,Mark Chronister, each of whom is independent under Nasdaq listing standards and the independence requirements of the Securities and Exchange Commission. The Compensation Committee metheld two timesmeetings in 2017.2021.

Governance Committee. Under its charter, the Governance Committee assists the Board in identifying qualified individuals to become directors, makes recommendations to the Board concerning the size, structure and composition of the Board and its committees, and monitors the process to assess the Board’s effectiveness. In evaluating potential nominees to the Board, the Governance Committee will consider the criteria set forth in our Governance Guidelines and will consider candidates proposed by shareholders and evaluates them using the same criteria as for other candidates. Our Governance Guidelines are available at www.canterburypark.com under the tab “Corporate Governance Documents” on the “Investors” page. In 2022, the Governance Committee adopted a formal diversity policy. When evaluating candidates for nomination as new directors, the Governance Committee will consider, and will ask any search firm that it engages to provide, a set of candidates that includes qualified women and individuals from historically underrepresented groups. In 2021, the Governance Committee began to exercise oversight on behalf of the Board over environmental, social, and governance (ESG) matters. In 2022, the charter of the Governance Committee expanded the responsibility of the Governance Committee to include the responsibility to periodically review and assess the Company’s significant ESG issues, risks, and trends, and oversee our engagement with, and disclosures to shareholders and other interested parties, concerning ESG matters. The current members of the Governance Committee are John S. Himle (Chair), Carin J. Offerman, and Maureen H. Bausch. The Governance Committee held two meetings in 2021.

MeetingAttendance.

Our Board of Directors meets regularly during the year to review matters affecting the Company and to act on matters requiring Board approval. TheIn 2021, the Canterbury Board formally met six times during 2017,held five regular meetings at which directors participated in person, or by telephone, or video conference, call. Frequently, in-personand in addition held several informal meetings in which all or a majority of Board members participated. Meetings generally included an executive session without the presence of non-independent directors and management.

Each of our directors is expected to make a reasonable effort to attend all meetings of the Board, applicable committee meetings and our annual meeting of shareholders. Each of our current directors attended at least 75% of the meetings of the Board and committees on which he or she served during 2017. In addition, all2021. Due to the COVID-19 pandemic, only three of the directors who were serving as of June 3, 2021 attended the Company’s 20172021 Annual Meeting of Shareholders.

Director Nominations.

Nominee Selection Process. The Governance Committee is responsible for identifying, evaluating and recommending qualified candidates for nomination as directors. The nominees for the Annual Meeting were selected by the Governance Committee in March 2022 and all nominees were elected by shareholders at the 2021 Annual Meeting of Shareholders. The Governance Committee will consider candidates for Board membership suggested by its members, other Board members, as well as management and shareholders, subject to the requirements of our bylaws.

When identifying and evaluating new nominees to the Board of Directors, the Governance Committee generally first establishes a profile of the new Board member based upon criteria for selection as a nominee and the specific qualities or skills being sought based on input from members of the Board and, if the Governance Committee deems appropriate, a third-party search firm. The Governance Committee evaluates any candidates identified by reviewing the candidates’ biographical information and qualifications and checking the candidates’ references. One or more Governance Committee members and other directors may interview the prospective nominees in person, by video or by telephone. After completing the evaluation, the Governance Committee makes a recommendation to the full Board of the nominees to be presented for the approval of the shareholders or for election to fill a vacancy.

As disclosed elsewhere, Mr. Schenian will not be standing for re-election at the Annual Meeting due to his retirement from the Board. As part of the Board succession planning process that is overseen by the Governance Committee, the Governance Committee has initiated a director recruitment process with a view toward enhancing the gaming, real estate and other expertise relevant to our business and strategic direction and enhancing the diversity of the Board. In that respect, in March 2022, the Governance Committee adopted a formal policy with respect to diversity through its charter. Under that policy, when evaluating candidates for nomination as new directors, the Governance Committee will consider, and will ask any search firm that it engages to provide, a set of candidates that includes qualified women and individuals from historically underrepresented groups.

Our Governance Guidelines provide that the Board should generally have between five and nine directors. Following the Annual Meeting, the Board of Directors will be comprised of five directors. The Governance Committee believes that a Board of six or seven directors would be most appropriate at this time and intends to target its director recruitment process accordingly. In determining the number of directors serving on the Board, the Governance Committee will seek to ensure that Board of Directors has a diversity of talent and experience to draw upon, is able to appropriately staff the committees of the Board and is able to engage the directors in Board and committee service, all while maintaining efficient function and communication among members.

Criteria for Nomination to Board; Diversity Policy. While the Governance Committee has no specific minimum qualifications for director nominees, the Governance Committee has adopted a policy regarding critical factors to be considered in selecting director nominees, which include:

| | 5● | the nominee’s personal and professional ethics, integrity and values; |

| | ● | the nominee’s intellect, judgment, foresight, skills, experience (including understanding of marketing, operations, finance, real estate development events, gaming/racing and other elements relevant to the success of an organization such as Canterbury Park) and achievements, all of which are viewed in the context of the overall composition of the Board; |

| ● | the absence of any conflict of interest (whether due to a business or personal relationship) or legal impediment to, or restriction on the nominee serving as a director; |

| ● | having a majority of independent directors on the Board; and |

| ● | representation of the long-term interests of the shareholders as a whole and a diversity of backgrounds and expertise, which are most needed and beneficial to the Board and Canterbury Park. |

Selecting Nominees for Election to the Board.

The independent members of our Board of Directors are responsible for recommending who will be presented as the Board’s nominees for election at our annual shareholder meetings. In selecting the nominees, the independent directors reviewGovernance Committee reviews the composition of the full Board to determine the qualifications and areas of expertise needed for effective governance.

The Governance Committee is committed to Board does not havediversity and takes into account the personal characteristics, experience and skills of current and prospective directors, including gender, race and ethnicity, to ensure that a broad range of perspectives is represented on the Board to effectively perform its governance role and oversee the execution of our strategy. As noted above, the Governance Committee adopted a formal policy with regardrespect to diversity. Neverthelessdiversity through its charter. Under that policy, when evaluating candidates for nomination as new directors, the Governance Committee will consider, and will ask any search firm that it engages to provide, a set of candidates that includes qualified women and individuals from historically underrepresented groups.

Canterbury Board Diversity. Recently adopted Nasdaq listing requirements require each listed company to have, or explain why it does not have, two diverse directors on the Board. Smaller reporting companies, like Canterbury Park, can achieve these diversity objectives by having two female directors. Accordingly, our current Board composition is in proposing nominees,compliance with the Nasdaq diversity requirements, which begin to take effect in addition to minimum requirementsAugust 2023.

The table below provides certain highlights of or commitment to purchasethe composition of our common stock, and a willingness to devote adequate time and effort tocurrent Board responsibilities,members. Each of the categories listed in the below table has the meaning as it is used in Nasdaq Rule 5605(f).

Board Diversity Matrix (As of April 7, 2022) |

Total Number of Directors | 6 |

| | Female | Male | Non-

Binary | Did Not

Disclose

Gender |

Part I: Gender Identity | |

Directors | 2 | 4 | 0 | 0 |

Part II: Demographic Background | | |

White | 2 | 4 | 0 | 0 |

LGBTQ+ | 0 |

Did Not Disclose Demographic Background | 0 |

Retiring Director.

Director Dale H. Schenian will be retiring from the Board seeksat the Annual Meeting and therefore, is not standing for reelection at the Annual Shareholders. We want to haveexpress our sincere appreciation for Mr. Schenian’s faithful and dedicated service. Mr. Schenian was a board that reflects diversityfounding director of the Company in relevant business experience, education, skills, business relationships1994 and associations,has been a director since the Company was incorporated. Mr. Schenian served as Vice Chair of the Board from 1994 to October 2019 and personal background,upon retiring as wellVice Chair of the Board, assumed the title as other factors that will contributeVice Chairman Emeritus. The continuing directors are grateful for Mr. Schenian’s loyal and dedicated service to Board oversight of management of the Company.

Nominations by Shareholders.

The Board of Directors will consider qualified individuals proposed by shareholders along with other potential candidates when determining what individuals it will recommend for election at our annual shareholders meeting. Shareholders can submit proposed candidates, together with appropriate biographical information, to the Board of Directors at: Canterbury Park Holding Corporation, 1100 Canterbury Road, Shakopee, Minnesota 55379, Attention: Chief Executive Officer. Submissions will be forwarded to the independent directors for review and consideration. Any shareholder desiring to submit a director candidate for consideration at our 2019 Annual Meeting of Shareholders must ensure that the submission is received by the Company no later than December 31, 2018 in order to provide adequate time for the independent directors to properly consider the candidate.

Our By-lawsbylaws provide that shareholders may directly nominate an individual for election to the Board at our shareholders meeting if certain procedures are followed. A shareholder wishing to formally nominate an individual to election to the Board at a future shareholder meeting should follow the procedure set forth below under the caption “Other Information – Shareholder Proposals and Nominees for 20192023 Annual Meeting -- Shareholder Nominations” at the end of this Proxy Statement.proxy statement.

Code of Conduct.

We have adopted a Code of Conduct (the “Code”) applicable to all of our officers, directors, employees and consultants that specifies guidelines for professional and ethical conduct in the workplace. The Code also incorporates a special set of guidelines applicable to our senior financial officers, including the chief executive officer, chief financial officer and others involved in preparation of our financial reports. These guidelines are intended to promote the ethical handling of conflicts of interest, full and fair disclosure in periodic reports filed by us and compliance with laws, rules and regulations concerning this periodic reporting.

Contacting the Board of Directors.

Any shareholder who desires to contact our Board of Directors may do so by writing to the Board of Directors, generally, or to an individual director at: Canterbury Park Holding Corporation, 1100 Canterbury Road, Shakopee, Minnesota 55379. Communications received electronically or in writing are distributed to the full Board of Directors, a committee or an individual director, as appropriate, depending on the facts and circumstances described in the communication received. For example, a complaint regarding accounting, internal accounting controls or auditing matters will be forwarded to the Chair of the Audit Committee for review. Complaints and other communications may be submitted on a confidential or anonymous basis.

Board Leadership.

The Board does not have a formal policy regarding separating the roles of Chief Executive Officer and Chair of the Board, although currently the two positions are separated. Both the Chair and Vice Chair, who together are the beneficial owners of approximately 31.0% of the Company’s stock, are actively engaged in providing leadership at the Board level in matters considered by the Board and in regard to establishing Board priorities.

Board’s’s Role in Managing Risk.

In general, management is responsible for the day-to-day management of the risks the Company faces, while the Board, acting as a whole and through the Audit Committee,its standing committees, has responsibility for oversight of risk management. Senior management attends the regular meetings of the Board and is available to address questions and concerns raised by the Board related to risk management, and our Board regularly discusses with management identified major risk exposures, their potential financial and other business impact on the Company and steps that can be taken to manage these risks.

The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to risk management in the areas of financial reporting, internal controls and compliance with legal and regulatory requirements. The Audit Committee reviews the Company’s financial statements and meets with the Company’s independent registered public accounting firm at regularly scheduled meetings to receive reports on the firm’s review of the Company’s financial statements.

Director Compensation.

The Compensation information paid to non-employee directors ofCommittee is responsible for managing risks in connection with our compensation policies, programs and practices and for managing risk associated with succession planning for the CompanyChief Executive Officer position. The Governance Committee is set forth below under the caption “Director Compensation.”

PROPOSAL 1

ELECTION OF DIRECTORS

The independent members ofresponsible for managing risk associated with succession planning for the Board of Directors, haveas well as ESG and corporate governance matters generally.

PROPOSAL 1

ELECTION OF DIRECTORS

The Governance Committee has nominated and recommend for election as our directors the five individuals named below, each of whom is a current director of the Company. The Board of Directors believes that each nominee named below will be able to serve, but if a nominee is unable to serve as a director, the persons named in the proxies have advised us that they would vote for the election of such substitute nominee as the independent members of the Board of DirectorsGovernance Committee may propose.

Information regarding the experience, qualifications and other attributes that qualify each of the nominees to serve on the Company’s Board is set forth below. In addition, information

MAUREEN H. BAUSCH, age 67, has served as a member of the Board since October 2019. Ms. Bausch is currently a partner in Bold North Associates, providing experiential and consulting services for retail, event and destination attraction businesses. Ms. Bausch served from December 2014 until February 2018 as CEO and an Executive Board Member of the Super Bowl Host Committee in connection with the February 4, 2018 Super Bowl LII held in Minneapolis. Prior to their respective ownershipthat, Ms. Bausch worked in positions of Company common stockincreasing responsibility at the Mall of America, serving most recently as Executive Vice President, managing the $1B asset. Ms. Bausch’s long and deep involvement and experience in the Minnesota community and the local retail, event and destination attraction businesses brings a good perspective to the Board with Canterbury’s continuing focus on its card casino, racing and special events.

MARK CHRONISTER, age 70, has been a director since October 1, 2020. Mr. Chronister retired in 2007 as an audit partner in the Minneapolis office of PricewaterhouseCoopers, LLP (PwC) after 34 years at the firm. From 2007 to current, Mr. Chronister has been focused on board and community service. Currently, Mr. Chronister is set forth below under “Security Ownershipan Advisory Board member of Certain Beneficial OwnersRiskClimate LLC, a start-up creating enterprise risk management software for higher education, the past chair of Finance and Management.Development Council for the Pax Christi Catholic Community, a past Treasurer and past Audit and Finance Committee Chair for the Science Museum of Minnesota, and an Advisory Board member for the Hendrickson Institute of Ethical Leadership, St. Mary’s University of Minnesota. Mark is also the Board Treasurer for the Minnesota USA Expo 2027. Mr. Chronister brings to the Board substantial financial expertise and he is an “audit committee financial expert.”

BURTON F. DAHLBERGJOHN S. HIMLE, age 85,67, has served as a member of the Board of the Company since October 2019. Mr. Himle is Chief Executive Officer of Himle LLC, a specialized consultancy that advises companies, not-for-profit entities and other organizations with insight and strategy related to shaping complex business decisions and related matters. Mr. Himle was the founder and Chief Executive Officer of Himle Horner Inc. and Himle Rapp and Co. before selling his interests in 2017. He also served five terms in the Minnesota House of Representatives holding a series of leadership positions, including Assistant Majority Leader and Assistant Minority Leader. Mr. Himle’s experience in, and knowledge of, government, regulatory matters, risk management, public relations and communications bring a helpful and well-informed perspective to the Company as the Company pursues its card casino, racing, special events and real estate development opportunities.

CARIN J. OFFERMAN, age 73, has been a director of the Company since 2004. Since 2003 he has been an independent commercial real estate consultant. From 1987 to 2002, Mr. Dahlberg was President and Chief Operating Officer of Kraus-Anderson Inc., a national firm engaged in commercial real estate development, construction, building management, finance and insurance brokerage services. From 1968 to 1987, Mr. Dahlberg held other, successively more responsible executive positions with Kraus-Anderson Inc. or one of its subsidiaries. In addition, from 1985 to 2005, Mr. Dahlberg was an owner and breeder of thoroughbred race horses1994 and was licensed to race thoroughbredsnamed lead independent director in Minnesota, Alabama, Florida, Illinois, Indiana, Iowa, Kansas, Kentucky, and Texas. Mr. Dahlberg also served on the board of the Minnesota Thoroughbred Association from 1988 to 1993, was its Vice President in 1989, and its President during 1990 and 1991. Mr. Dahlberg’s knowledge and experience gained from a 35-year career in commercial real estate construction, management and finance is extremely valuable to the Board’s understanding and oversight of the Company’s maintenance and improvement of its facilities, as well as the Company’s assessment and pursuit of opportunities for developing its unused and underutilized land.

CARIN J. OFFERMAN, age 69, has been a director of the Company since 1994.October 2019. Ms. Offerman is currently engaged in private investment activities and is a principal in Puppy Good Start which provides dog training services.activities. From 1997 to 2000, Ms. Offerman was the President and CEO of Offerman & Company, a regional investment banking and retail broker-dealer firm, and from 1990 to 1997 was its Executive Vice President. Prior to 1990, Ms. Offerman served in various capacities with Offerman & Company for the preceding six years, including as registered representative and sales retail manager. Ms. Offerman was a member of the board of the Minnesota Thoroughbred Association from 1993 to 1996 and served as its President in 1993 and 1994. Ms. Offerman has been an owner and breeder of both show horses and thoroughbreds, and she has been or is currently licensed as a horse owner in Minnesota, Iowa and Nebraska. Since 1991 she has beenMs. Offerman was also a member of the Minnesota Racing Commission’s Breeders Fund Advisory Board and served as its Chair since 2003.from 2003 to 2017. As a member of the Company’s Board of Directors, Ms. Offerman brings a unique blend of entrepreneurial experience, knowledge and experience in investment banking and finance, and a deepan understanding of the local and national horse industry.

CURTIS A. SAMPSON, age 84, co-founded the Company in 1994 and has been a director and Chair of its Board since the Company was incorporated. Mr. Sampson founded and has been the Chairman of the Board of Communications Systems, Inc. (“CSI”), a public company principally engaged in manufacturing and selling products for the telecommunications and data communications industries since 1969. Mr. Sampson served as the CEO of CSI from 1969 to 2007, and as interim CEO from September 2013 to June 2014. Mr. Sampson is a Regent of Augsburg College in Minneapolis, Minnesota and a member of the Emeritus Board of Advisors of the University of Minnesota’s Carlson School of Business. Over the course of his career, Mr. Sampson has served on non-profit boards, telephone industry

association boards, private company boards and the following public company boards: Nature Vision, Inc. (2001 to 2009) and Hector Communications Corporation (1990 to 2006). Mr. Sampson is the owner of Sampson Farms (crop farming and a breeder of thoroughbred horses) based in Hector, Minnesota and he is currently, or has been in the past, licensed as a horse owner in Arkansas, Florida, Illinois, Iowa, Kentucky, Minnesota, Nebraska and Oklahoma. The distinctive perspective Mr. C.A. Sampson brings to the Board is his extensive and wide ranging knowledge and experience in business, management and corporate finance gained over more than 40 years leading sizable enterprises, his knowledge of the thoroughbred horse racing industry and, as one of the Company’s largest shareholders, one that has a substantial stake in the Board’s efforts to build shareholder value.

RANDALL D. SAMPSON, age 60,64, co-founded the Company with his father and director Dale Schenian in 1994 and has served as its President and Chief Executive Officer and on the Company’s Board of Directors since inception. Mr. Sampson was also named Executive Chairman of the Board on October 3, 2019. After graduating from college with a degree in accounting, Mr. Sampson worked for five years in the audit department of Deloitte & Touche where he earned his CPA certification. He subsequently gained experience as a controller of a private company and, thereafter, served as a Chief Financial Officer of a public company before becoming one of the three co-founders of Canterbury Park Holding Corporation in 1994. From 1987 to 1994, R.D.Mr. Sampson also managed Sampson Farms.Farms, a thoroughbred breeding and racing operation. Since 1999, Mr. Sampson has been a director of Communications Systems, Inc. Mr. Sampson is also a director and former vice president and director of the Thoroughbred Racing Association of North America. Prior to becoming Chief Executive Officer, Mr. Sampson was a horse owner and active in horse industry associations and advisory boards. As the Company’s Executive Chairman and Chief Executive Officer, Mr. Sampson brings to the Board deeplong-time experience in the horse industry, financial expertise andwith over 25 years of operating history at Canterbury Park, an in-depth understanding of the Company’s personnel, operations, real estate development efforts, financial results performance, financial position, challenges and opportunities.

DALE H. SCHENIAN, age 76, co-founded the Company and has been Vice Chair of the Board since 1994. From 1990 to 2004, Mr. Schenian was President and Chief Executive Officer of City Auto Glass Companies, a company he founded in 1990, and continued to serve as its Chairman of the Board until December 2015. Under his leadership, City Auto Glass grew from a start-up to an enterprise with facilities in more than 20 locations in Minnesota, western Wisconsin and northern Iowa. For approximately 30 years preceding launching City Auto Glass, Mr. Schenian either owned or worked for other companies in the highly competitive auto glass industry. In addition to other leadership roles in other business and community organizations, Mr. Schenian served on the board of Bremer Bank from 1984 to 2009. Mr. Schenian, from 1985 to present, has also been an owner and breeder of thoroughbred race horses licensed in Minnesota, Illinois, Texas, Kansas, Oklahoma, Kentucky, Iowa and Nebraska. Mr. Schenian’s perspective is that of one whose career has been dedicated to building businesses in a highly competitive service industry, who has a high degree of knowledge about the horse racing industry and, as one of the Company’s largest shareholders, who has a significant stake in the Board’s efforts to build shareholder value.

Board Voting Recommendation.

The Board of Directors unamimously recommends a vote “For” each of the nominees listed above.Unanimously Recommends

Shareholders Vote “FOR” Each Nominee Identified in Proposal 1.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, based upon information available as of April 11, 2018,7, 2022, the beneficial ownership of shares of our common stock (i) by each person known by us to own of record or beneficially five percent or more of our common stock; (ii) by the current Named Executive Officers listed in the Summary Compensation Table below; (iii) by each of our directors, andwho are also the director nominees; and (iv) by all of our current executive officers and directors as a group. Unless otherwise indicated, the persons listed below may be contacted by mail at 1100 Canterbury Road, Shakopee, Minnesota 55379.

Name and Address of Beneficial Owner | | Amount and Nature of Beneficial Ownership | | (1) | | Percent of Class | |

| | | | | | | | | | |

Randall D. Sampson (2)(3)(4) | | | 1,135,818 | | (5) | | | 23.5 | % |

| | | | | | | | | | |

Gabelli Asset Management, Inc. | | | 612,188 | | (6) | | | 12.7 | % |

One Corporate Center | | | | | | | | | |

Rye, New York 10580-1435 | | | | | | | | | |

| | | | | | | | | | |

Black Diamond Capital Management, LLC | | | 593,427 | | (7) | | | 12.3 | % |

2187 Atlantic Street | | | | | | | | | |

Stamford, CT 06902 | | | | | | | | | |

| | | | | | | | | | |

Gate City Capital Management, LLC | | | 249,681 | | (8) | | | 5.2 | % |

425 South Financial Place | | | | | | | | | |

Chicago, IL 60605 | | | | | | | | | |

| | | | | | | | | | |

Dale H. Schenian (3) | | | 525,819 | | (9) | | | 10.9 | % |

Carin J. Offerman (3)(4) | | | 109,564 | | | | | 2.3 | % |

Mark Chronister (3)(4) | | | 4,240 | | | | | * | |

John S. Himle (3)(4) | | | 8,162 | | | | | * | |

Maureen H. Bausch (3)(4) | | | 7,801 | | | | | * | |

Randy J. Dehmer (2) | | | 13,354 | | | | | * | |

All current directors and executive officers as a group (7 persons) | | | 1,804,758 | | | | | 37.4 | % |

| Name and Address of Beneficial Owner | | Amount and Nature of

Beneficial Ownership | (1)(2) | | Percent of

Class | (1)(2) |

| | | | | | | |

| Curtis A. Sampson | | 870,703 | (3) | | 19.6% | |

| Gabelli Asset Management, Inc. | | | | | | |

| One Corporate Center | | 934,909 | (4) | | 21.0% | |

| Rye, New York 10580-1435 | | | | | | |

| Randall D. Sampson | | 612,681 | (5) | | 13.8% | |

| Dale H. Schenian | | 509,846 | (6) | | 11.5% | |

| Carin J. Offerman | | 97,048 | | | 2.2% | |

| Burton F. Dahlberg | | 13,821 | | | * | |

| Robert M. Wolf | | 1,271 | | | * | |

| Daniel J. Kennedy | | 651 | | | * | |

| All current directors and executive officers as a group (7 persons) | | 2,103,410 | | | 47.3% | |

* | * | Indicates ownership of less than one percent |

(1) | (1) | Includes the following number of shares not currently outstanding but deemed beneficially owned by virtue of the right of a person or group to acquire them within 60 days of April 11, 2018.7, 2022 as follows: Mr. Sampson, 0 shares; Mr. Schenian, 5,755 shares; Ms. Offerman, 8,013 shares; Mr. Chronister, 4,240 shares; Mr. Himle, 6,568 shares; Ms. Bausch, 6,207 shares; Mr. Dehmer, 0 shares, and all current directors and executive officers as a group, 30,783 shares. These shares are treated as outstanding only when determining the amount and percent owned by the respective individual or group. |

(2) | (2) | Includes the following number of shares that may be acquired upon exercise of stock options exercisable within sixty days after April 11, 2018: Mr. C. Sampson, 9,000 shares; Mr. R. Sampson, 30,000 shares; Mr. Schenian, 9,000 shares; Mr. Dahlberg, 3,000 shares; and all director and officers as a group, 51,000 shares.Named Executive Officer. |

(4) | Nominee for election at the Annual Meeting. |

(5) | Includes the following: 11,300(i) 136,694 shares of common stock held by Mr. C. Sampson’s spouse as to which beneficial ownership is disclaimed, 344,000 shares owned by the Marian Arlis Sampson 2012 Family IrrevocableExempt Marital Trust, of which Mr. Sampson is one of five trustees and 53,000 shares ownedMr. Sampson and another trustee each have been delegated authority by the Curtis A. Sampson 2012 Family Irrevocable Trust.trustees to act alone; (ii) 58,200 shares of common stock held by the Marian Arlis Sampson Revocable Trust, of which Mr. Sampson is the sole trustee; (iii) 140 shares of common stock held by the Marian Sampson IRA, of which Mr. C. Sampson’sSampson is an attorney-in-fact authorized to act alone and Ms. Sampson retains authority to act on behalf of the Marian Sampson IRA; (iv) 667,387 shares of common stock held by Sampson Family Real Estate Holdings, LLC, of which Mr. Sampson is the sole manager; and (v) 300 shares of common stock held by the Sampson Family Foundation, a charitable foundation of which Mr. Sampson is one of five directors. The two officers of the Sampson Family Foundation have the authority to vote and dispose of the shares of common stock held by the Sampson Family Foundation. Mr. Sampson is not an officer of the Sampson Family Foundation. Mr. Sampson disclaims beneficial ownership of all of the shares of the Company’s common stock except those shares he holds individually or jointly with his spouse. |

(6) | (4) | Based upon Amendment 2025 to Schedule 13D filed by GAMCO Investors, Inc. on November 13, 2017,March 18, 2021, which includesreports shares beneficially owned as of March 17, 2021 by Gabelli Funds, GAMCO Asset Management, Teton Advisors, Inc., Gabelli Securities,& Company Investment Advisors, Inc. and MJG Associates, Inc. |

(7) | (5) | Includes 344,000 shares ownedBased upon Amendment No. 2 to Schedule 13G filed by the Marian Arlis Sampson 2012 Family Irrevocable Trust. Mr. R. Sampson is trustee of this trust but disclaimsBlack Diamond Capital Management, L.L.C. and Stephen H. Deckhoff, on February 14, 2022 reporting beneficial ownership as of any shares held by the trust.December 31, 2021. |

(8) | (6)Based upon Amendment No. 1 to Schedule 13G filed by Gate City Capital Management, LLC, on February 14, 2022 reporting beneficial ownership as of December 31, 2021. |

(9) | Includes 33,000 shares held by Mr. Schenian’s spouse as to which beneficial ownership is disclaimed. |

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors, consistingwhich currently consists of Burton F. DahlbergMark Chronister (Chair), Carin J. Offerman, and Dale H. SchenianJohn S. Himle, held four meetings during 20172021 with management and our independent registered public accounting firm. These meetings werealso included executive sessions designed to facilitate and encourage private communication between the Audit Committee and our independent registered public accounting firm.

The Audit Committee reviewed and discussed the audited financial statements of the Company for the year ended December 31, 20172021 with management and Wipfli at its meeting on March 20, 2018.16, 2022. Management represented to the Audit Committee that our consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent registered public accounting firm. The Audit Committee also reviewed and discussed with the independent registered public accounting firm, the firm’s judgments as to the quality of the accounting principles applied in our financial reporting and the critical audit matter (‘‘CAM’’) addressed in the audit and the relevant financial statement accounts or disclosures that relate to the CAM. The discussions with Wipfli also included the matters required to be discussed by the applicable auditing standards as periodically amended (including significant accounting policies, alternative accounting treatments and estimates, judgments and uncertainties).

Wipfli also provided to the Audit Committee the written disclosures and the letter regarding its independence required by PCAOB Auditing Standard No. 16. This information was discussed with the Audit Committee.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that our audited consolidated financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 20172021 for filing with the Securities and Exchange Commission.

By the Audit Committee of the Board of Directors:

Mark Chronister (Chair)

Carin J. Offerman

John S. Himle

PROPOSAL 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

ACCOUNTING FIRM

Wipfli LLP has been the Company’s independent registered public accounting firm since August 31, 2014. The Board of Directors, upon recommendation of the Audit Committee, is requesting shareholder ratification of the appointment of Wipfli to serve as the independent registered public accounting firm for the Company for the current fiscal year ending December 31, 2018.2022. A representative of Wipfli is expected to be present at the Annual Meeting of Shareholders, will have an opportunity to make a statement and will be available to respond to appropriate questions.

Fees Billed and Paid to Independent Registered Public Accounting Firms.

The table below provides a summary of fees paid to Wipfli for professional services rendered in the two fiscal years ended December 31, 20172021 and 2016:2020:

Fee Category | | | 2021 | | | 2020 | |

| | | 2017 | | 2016 | | | | | | | | | |

| Fee Category | | | | | | |

| Audit Fees | | $ | 116,100 | | | $ | 114,900 | | | $ | 192,040 | | | $ | 144,462 | |

| Audit-Related Fees | | | - | | | | - | | | | 2,500 | | | | - | |

| Tax Fees | | | - | | | | - | | | | - | | | | - | |

| All Other Fees | | | 3,150 | | | | 6,190 | | | | - | | | | - | |

| Total Fees | | $ | 119,250 | | | $ | 121,090 | | | $ | 194,540 | | | $ | 144,694 | |

Audit Fees. This category consists of fees billed for professional services rendered for the audit of our annual financial statements and review of financial statements included in our quarterly reports, and auditing of our benefit plans.plans, and the issuance of consent in connection with registration statement filings with the SEC.

Audit-Related Fees. This category consists of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements and are not otherwise reported under “Audit Fees.” In 2021, the Company paid Wipfli $2,500 for developing agreed upon procedures required under a material contract with a third party. The Company paid Wipfli no audit-relatedsuch fees to Wipfli in 2017 or 2016.2020.

Tax Fees. This category consists of fees billed for professional services for tax compliance, tax advice and tax planning. These services include assistance regarding federal and state tax compliance and acquisitions. The Company paid no fees to Wipfli for tax compliance, tax advice, or tax planning in 20172021 or 2016.2020.

All Other Fees. This category consists of all fees paid to the independent registered public accounting firm for matters than the three listed above. The Company paid Wipfli for developing agreed upon procedures required under a material contract with a third partyno such fees in 2017 and 2016. The Company also paid Wipfli for assistance in preparing a registration statement/prospectus related to our 2016 Reorganization into a holding company structure.2021 or 2020.

Audit Committee Pre-Approval Policies and Procedures.

In addition to approvingWe have adopted a written pre-approval policy for the engagement of the independent registered public accounting firm to audit our consolidated financial statements, it is the policy ofAudit Committee that require the Audit Committee to approve any use of that firm forpre-approve all audit and all permitted non-audit engagements and services prior to any engagement. To minimize relationships that could appear to impair(including the objectivity offees and terms thereof) by the independent registered public accounting firm¸ it isauditors, except that the policyAudit Committee may delegate the authority to pre-approve any engagement or service less than $10,000 to one of its members, but requires that the member report such pre-approval at the next full Audit

Committee to restrict the non-auditmeeting. The Audit Committee may not delegate its pre-approval authority for any services that may be provided to usrendered by our independent registered public accounting firmauditors relating to services that clearly would not compromise the independenceinternal controls. This pre-approval policy prohibits delegation of the firm.Audit Committee’s responsibilities to our management. Under the pre-approval policy, the Audit Committee may pre-approve specifically described categories of services which are expected to be conducted over the subsequent twelve months on its own volition, or upon application by management or the independent auditor. The policy prohibits the Audit Committee from approving certain non-audit services may not be provided by the independent auditor under law.

All of the services described above for 2021 and 2020 were pre-approved by the Audit Committee before Wipfli was engaged to render the services.

Vote Required for Shareholder Approval.

The affirmative vote of a majority of the outstanding shares of the Company’s common stock voting at the annual meeting in person or by proxy is required for shareholder ratification of appointingthe appointment of Wipfli to serve as the Company’s independent registered public accounting firm for the 20182022 fiscal year.

Board Voting Recommendation.

The Board of Directors unanimously recommends a vote “For” ratificationUnanimously Recommends

Shareholders Vote “FOR”

Proposal 2: Ratification of Appointment of Wipfli LLPLLP.

PROPOSAL 3

ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION

Our Board of Directors determined that an advisory vote on named executive officer compensation (commonly referred to as Independent Registered Public Accounting Firm“say-on-pay”) will be held every three years. As required by Section 14A of the Securities Exchange Act of 1934, we are asking shareholders to cast an advisory vote on named executive officer compensation.

As described in the section entitled “Executive Compensation Programs and Practices,” we have designed our executive compensation program to implement core compensation principles, including pay for performance and alignment of our management’s interests with those of our shareholders. Under these programs, we reward our Named Executive Officers in large part for the year ended December 31, 2018.achievement of specific financial performance goals and design incentive compensation programs to drive achievement of financial performance, both in the short-term and long-term. We encourage shareholders to read the “Executive Compensation Programs and Practices” section of this proxy statement for a more detailed discussion of our executive compensation programs, including information about 2021 compensation of our Named Executive Officers.

The say-on-pay proposal presented at our 2019 Annual Meeting of Shareholders received 98.7% approval by our shareholders. Although the vote was non-binding, the Compensation Committee believes this level of approval percentage indicates that our shareholders strongly support our core compensation principles and our executive compensation program.

We are asking our shareholders to indicate their support for our Named Executive Officer compensation as described in this proxy statement. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our Named Executive Officers and the philosophy, policies and practices described in this proxy statement. Accordingly, we ask our shareholder to vote “FOR” the following resolution at the Annual Meeting:

RESOLVED, that the shareholders of Canterbury Park Holding Corporation approve, on an advisory basis, the compensation of the Named Executive Officers as disclosed in Canterbury Park Holding Corporation’s proxy statement for the 2022 Annual Meeting of Shareholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission.

Vote Required for Shareholder Approval.

Approval of this Proposal 3 requires the affirmative vote of the holders of the majority of the shares present, in person or by proxy, and entitled to vote on this Proposal 3. While this vote is advisory, and not binding on the Compensation Committee or the Board of Directors, it will provide valuable information that the Compensation Committee will be able to consider when determining executive compensation philosophy, policies and practices for the remainder of 2022 and future years.

Board Voting Recommendation.

The Board of Directors Unanimously Recommends

Shareholders Vote “FOR”

Proposal 3: Advisory Vote to Approve Named Executive Officer Compensation.

EXECUTIVE COMPENSATION PROGRAMS AND PRACTICES

Role of the Compensation Committee in the Compensation Process.

The Compensation Committee has the following duties and responsibilities:responsibilities relating to executive compensation:

| ·● | To review, approve and oversee our overall compensation strategy; |

| ·● | To review and approverecommend the compensation and other terms of employment of Randall D. Sampson, our Chief Executive Officer, and other currently employed individualsexecutive officers (our executive officers that are identified underin the “Summary Compensation Table” below (collectively,are referred to as the “Named Executive Officers” or “NEOs”) and other officers and key employees,, and recommend to the entire Board the compensation and the other terms of employment of these officersofficers; and key employees; |

| ·● | To make recommendations to the Board regarding the amount of directors’ fees and other compensation for Board members, including retainer, Board meeting, committee and committee chair fees and director equity awards; |

| · | To oversee the administration of the Company’s incentive-based or equity-based compensation plans and periodically consider and recommend changes in existing plans or the adoption of other or additional equity-based compensation plans; and, |

plans.

| · | To provide oversight for our 401(k) Plan, and any similar plans, including matters such as available investment options, performance, participation, administration, and review and approve generally the cost and scope of our other employee benefit plans. |

Under its charter, the Compensation Committee has the authority to engage the services of outside advisors, experts and others to assist it in performing its duties. In January 2016,October 2019, the Compensation Committee engaged Total Rewards Group, LLC, an executive compensation consulting firm, to advise us on whether our approach to executive compensation is, in general, competitiveprovide recommendations and to suggest ways we might enhance our programs and practices. Based on information suppliedadvice to the Compensation Committee. The Compensation Committee continued to refer to these recommendations and advice in 2016 by Total Rewards Group, the Committee concluded its basesetting compensation programs for Named Executive Officers and other key employees is generally competitive when compared to similar businesses. Based, in part, with Total Rewards Group’s assistance in February 2016, the Committee also developed and the Company’s Board approved two new incentive compensation plans discussed2021 as described below. The decision to engage Total Reward Group was made by the Committee.

In discharging its responsibilities, the Compensation Committee solicits certain information and advice from our President and Chief Executive Officer, our Senior Vice President of Finance and Chief ExecutiveFinancial Officer, and our Vice President of Human Resources. These officers participate in the deliberations of the Compensation Committee regarding compensation of other employees, including providing information regarding salary history, historical bonus practices and related financial data, the responsibilities and performance of employees and recommendations regarding the appropriate levels of compensation, but do not take part in deliberations regarding their own compensation.

Objectives of ourOur Compensation Programs.

It is the objective of the Compensation Committee to provide competitive levels of compensation that will attract, motivate and retain executives with superior leadership and management abilities and to provide incentives to executive officers so that we may achieve superior financial performance and to structure the forms of compensation paid to align the interests of our executive officers with those of the Company. With these objectives in mind, it has been our practice to provide a mix of base salary, bonus compensation, long-term, equity-based compensation and retirement compensation. Historically, base salary has represented approximately 75% or more of the total value of executive officer compensation, with cash bonuses, the value of long-term equity compensation and retirement compensation comprising the remainder. The Compensation Committee believes that these forms of compensation provide an appropriate combination of competitive fixed pay and variable pay as incentives to motivate superior short-term operational performance balanced with other incentives to achieve longer term operational goals and positive long-term stock price performance.

Information about the Components of our Compensation Programs.

Base Salary and Deferred Stock In Lieu of Increases

We establish base salaries for our executive officers by reference to base salaries paid to executives in similar positions with similar responsibilities. We review the base salaries annually and adjustments, if any, are usually made in February or March of each year. The Compensation Committee consider other factors, including Company financial performance and subjective judgments by the Compensation Committee on individual performance based on factors such as development and execution of strategic plans, changes in areas of responsibility, the development and management of employees and participation in industry, regulatory or political initiatives beneficial to our business. The Compensation Committee does not, however, assign specific weights to these various qualitative factors in making decisions on base compensation.

For 2020, the Compensation Committee considered the input of its compensation consultant, Total Rewards Group, in setting the initial 2020 base salaries for the named executive officers, which reflected a 3% increase from 2019. The 20182020 initial base salaries of Messrs. Sampson and Dehmer were $271,465 and $200,000, respectively.

Beginning on April 1, 2020, the salaries for our Named Executive Officers arewere significantly impacted by our efforts to reduce expenses and preserve liquidity in response to the COVID-19 pandemic and its impact on our business. In response, the Compensation Committee implemented as follows:

Name and Title | 2018 Salary |

Randall D. Sampson

President & Chief Executive Officer | $264,844 |

Daniel J. Kennedy

Senior Vice President of Operations | $227,813 |

Robert M. Wolf

Senior Vice President of Finance and Chief Financial Officer | $181,500 |

series of adjustments beginning on April 1, 2020 that resulted in the base salaries of Messrs. Sampson and Dehmer being at a reduced level from April 1, 2020 to the end of 2020. At the end of 2020, Mr. Sampson’s and Mr. Dehmer’s base salaries then in effect reflected a total reduction of 25% and 20% from their respective initial base salaries set at the beginning of 2020.

On January 27, 2021, the Board of Directors approved, based upon the recommendation of the Compensation Committee, a 10% increase in the then-effective base salaries of Mr. Sampson and Mr. Dehmer given our expectations that we would be able to return to more normalized operations in 2021. However, the base salaries of Mr. Sampson and Mr. Dehmer continued to be reduced as compared to their base salaries in effect at the beginning of 2020.

In February 2021, the Compensation Committee again reviewed base salaries for executive officers in light of our business, our plans for operations and the impacts of the COVID-19 pandemic at that time. While recognizing the need to preserve cash and liquidity in 2021, the Compensation Committee also recognized the contributions of these executive officers in their roles and the desire of the Compensation Committee to deliver market-competitive base pay. In order to address these competing factors, the Compensation Committee approved an award of deferred stock instead of increasing the base salaries of Messrs. Sampson and Dehmer at that time. The Compensation Committee viewed the deferred stock awards as a means to deliver value to the executives without utilizing cash and without subjecting the executives to the volatility of our stock price as with a stock option. The Compensation Committee approved an award of deferred stock to Messrs. Sampson and Dehmer of 3,600 shares and 1,800 shares, with vesting on the one-year anniversary of the date of grant. The deferred stock award corresponded to the approximate decrease in base salary for Messrs. Sampson and Dehmer of $42,643 and $21,500, respectively, if continued throughout 2021. The one-year vesting corresponded to the time frame in which the Compensation Committee intended to deliver the award’s value given that the deferred stock awards were in lieu of an increase to annual base salaries.

On October 13, 2021, the Board of Directors approved, based on the recommendation of the Compensation Committee, merit increases in the annual base salaries of Mr. Sampson and Mr. Dehmer due to our strong financial performance through the third quarter of 2021, which continued into the fourth quarter of 2021. Mr. Sampson’s base salary was increased to $250,357, or an 8.5% merit increase; and Mr. Dehmer’s bases salary was increased to $210,000, or a 5% merit increase. The increase was effective the first pay period in July 2021. At that time and through the remainder of 2021, Mr. Sampson’s adjusted base salary of $250,357 continued to be less than his pre-COVID-19 pandemic base salary of $271,465.

Bonus Compensation for 2021

CashHistorically, the Compensation Committee has used cash bonuses are intended to provide exempt level employees, including executive officers, with an opportunity to receive additional cash compensation, but only if earned based on individual performance and the Company’s financial performance. The CompanyEach year, the Compensation Committee has typically adopted a plan for paying annual incentive compensation to the Company’s NEOs, as well as other officers and key employees called the Canterbury Park Annual Incentive Plan (the “Annual Bonus Plan”).annual incentive plan. Under the Annual Bonus Plan,annual incentive plan, participating employees including the Company selects performance measures and establishes related performance goals under which these eligible employees have the opportunityNEOs were able to earn an annual bonus based on actual achievement compared to performance goals. Concurrently, these eligible employees are granted personal opportunities (“Incentive Awards”) to receive a payment of cash (“Payout”) based on the Company’s annual financial performance compared to the pre-established goals. The Payout for 2017 was determined by reference to two financial metrics: (i) achievement in relation to a performance goal for earnings (defined as “Adjusted Net Income From Operations”) and (ii) achievement in relation to a performance goal for consolidated Company revenue (defined as “Revenue”). Each eligible employee’s target opportunity for a Payout was based 70% on 2017 Company Adjusted Net Income From Operations and 30% on Revenue.